News & Articles Malaysian ringgit under pressure

Malaysian ringgit under pressure

23 Dec 2015

PETALING JAYA: With supply continuing to exceed demand, it is hard to see where global crude oil will find its bottom. And for that matter, when the pressure on the ringgit will abate.

Global oil prices rebounded yesterday after hitting their 11-year lows on Monday. But the Malaysian economy remains under pressure due to concerns over the impact of persistently weak oil prices on the country’s economy, as well as the risk of a further devaluation of the yuan.

International benchmark Brent crude rose almost 1% to US$36.68 per barrel at 5pm yesterday ahead of the release of the US crude inventory and production report by the Energy Information Administration report later today.

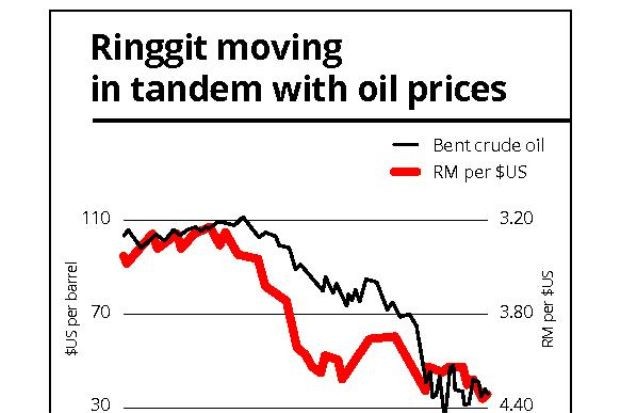

Separately, the ringgit weakened to close at 4.3005 against the US dollar, compared with 4.2945 against the greenback on Monday. This was in tandem with the movement of crude prices, which fell to their lowest since July 2004 at US$36.35 per barrel on Monday.

ADVERTISEMENT

The present level of oil prices is a far cry from the US$115 per barrel registered in June 2014.

Brent crude oil prices had hit an all-time high of US$147 per barrel in July 2008.

Declining crude oil prices have a negative impact on investor sentiment towards Malaysia due to the country’s reliance on oil and gas (O&G) as a source of revenue, and the sector as one of its key drivers of economic growth.

“The crude oil price situation is certainly one of the major risks to watch out for next year, as it is one of the factors that have contributed to the downward pressure on the ringgit ... the main issue here is the implication on the country’s budget deficit,” Maybank Investment Bank group chief economist Suhaimi Ilias said.

“In our estimate, if the average crude oil prices were to decline by another US$10 per barrel from what the Government had estimated, there could be a risk of Malaysia’s budget deficit widening by another 0.5%, and that could be a dampener to the ringgit,” Suhaimi explained to StarBiz.

Malaysia in October had unveiled its Budget 2016 based on the assumption that Brent crude oil prices would average US$48 per barrel. The budget had estimated about 19% of the Government’s

revenue next year to come from O&G-related activities.

The Government’s target was to cut its budget deficit-to-gross domestic product ratio next year to 3.1% from the estimated 3.2% in 2015.

Minister in the Prime Minister’s Department Datuk Seri Abdul Wahid Omar conceded last week that the Government would review Budget 2016 if Brent crude oil prices were to remain at the current low levels.

“While investors have mostly priced in low oil prices and a weak ringgit, no one is expecting both oil prices and the ringgit to suddenly recover, as there is just no catalyst in sight,” said a research head from a local brokerage.

Having lost about 18% against the US dollar since the beginning of 2015, the ringgit stands as the worst-performing currency in Asia year-to-date.

To a large extent, the weakness of the ringgit has been attributable to declining crude oil prices, which exacerbated the impact on Malaysia of ongoing foreign capital outflows from emerging economies, as the United States prepared to raise its interest rates.

Analysts and leaders of major oil firms said there was little sign that global crude oil prices could strengthen any time soon. The consensus expectation was that prices of the commodity would remain weak throughout 2016, as they had done this year.

At present, the main reason for the downward pressure on global crude oil prices was the ample supply caused by the Organisation of the Petroleum Exporting Countries’ (Opec) recent decision of not limiting its output and strong production of non-Opec members.

MIDF Research, however, is not too negative about the direction of global crude oil prices next year.

“Moving into 2016, we expect Brent crude oil prices to possibly trade within an average of US$50 per barrel – our view largely rests on a better second half of the year,” the brokerage said, adding that its assumption was based on the global asset breakeven prices and average fiscal breakeven prices for global oil-producing countries.

“Despite contradicting views in the media from various Opec members regarding oil price expectations and production levels, we are of the opinion that the low oil price climate will negatively affect all of the Opec members which could cause the cartel to eventually scale down production,” MIDF explained.

Meanwhile, there are also concerns that China would resume its move to devalue the yuan against the US dollar – something the world’s second largest economy has been doing over the past 10 days. Further devaluation of the yuan could add pressure on other Asian currencies, including the ringgit.

“The fear is that China is deliberately devaluing its currency to boost exports and the country’s growth ... any further sharp devaluation of the yuan could create fresh turmoil in regional currencies, including the ringgit,” Suhaimi said.

Beijing has halted the devaluation of the yuan since Monday.

The yuan reference rate was set at 6.4746 to the US dollar on Tuesday, compared with 6.4753 a day earlier, and after having lowered the value of the currency by about 1.3% in the previous two weeks. The yuan is allowed to trade within 2% above or below the fixed rate.

HSBC has projected the yuan to be devalued further to around 6.7 to the US dollar by the end of 2016.

Global oil prices rebounded yesterday after hitting their 11-year lows on Monday. But the Malaysian economy remains under pressure due to concerns over the impact of persistently weak oil prices on the country’s economy, as well as the risk of a further devaluation of the yuan.

International benchmark Brent crude rose almost 1% to US$36.68 per barrel at 5pm yesterday ahead of the release of the US crude inventory and production report by the Energy Information Administration report later today.

Separately, the ringgit weakened to close at 4.3005 against the US dollar, compared with 4.2945 against the greenback on Monday. This was in tandem with the movement of crude prices, which fell to their lowest since July 2004 at US$36.35 per barrel on Monday.

ADVERTISEMENT

The present level of oil prices is a far cry from the US$115 per barrel registered in June 2014.

Brent crude oil prices had hit an all-time high of US$147 per barrel in July 2008.

Declining crude oil prices have a negative impact on investor sentiment towards Malaysia due to the country’s reliance on oil and gas (O&G) as a source of revenue, and the sector as one of its key drivers of economic growth.

“The crude oil price situation is certainly one of the major risks to watch out for next year, as it is one of the factors that have contributed to the downward pressure on the ringgit ... the main issue here is the implication on the country’s budget deficit,” Maybank Investment Bank group chief economist Suhaimi Ilias said.

“In our estimate, if the average crude oil prices were to decline by another US$10 per barrel from what the Government had estimated, there could be a risk of Malaysia’s budget deficit widening by another 0.5%, and that could be a dampener to the ringgit,” Suhaimi explained to StarBiz.

Malaysia in October had unveiled its Budget 2016 based on the assumption that Brent crude oil prices would average US$48 per barrel. The budget had estimated about 19% of the Government’s

revenue next year to come from O&G-related activities.

The Government’s target was to cut its budget deficit-to-gross domestic product ratio next year to 3.1% from the estimated 3.2% in 2015.

Minister in the Prime Minister’s Department Datuk Seri Abdul Wahid Omar conceded last week that the Government would review Budget 2016 if Brent crude oil prices were to remain at the current low levels.

“While investors have mostly priced in low oil prices and a weak ringgit, no one is expecting both oil prices and the ringgit to suddenly recover, as there is just no catalyst in sight,” said a research head from a local brokerage.

Having lost about 18% against the US dollar since the beginning of 2015, the ringgit stands as the worst-performing currency in Asia year-to-date.

To a large extent, the weakness of the ringgit has been attributable to declining crude oil prices, which exacerbated the impact on Malaysia of ongoing foreign capital outflows from emerging economies, as the United States prepared to raise its interest rates.

Analysts and leaders of major oil firms said there was little sign that global crude oil prices could strengthen any time soon. The consensus expectation was that prices of the commodity would remain weak throughout 2016, as they had done this year.

At present, the main reason for the downward pressure on global crude oil prices was the ample supply caused by the Organisation of the Petroleum Exporting Countries’ (Opec) recent decision of not limiting its output and strong production of non-Opec members.

MIDF Research, however, is not too negative about the direction of global crude oil prices next year.

“Moving into 2016, we expect Brent crude oil prices to possibly trade within an average of US$50 per barrel – our view largely rests on a better second half of the year,” the brokerage said, adding that its assumption was based on the global asset breakeven prices and average fiscal breakeven prices for global oil-producing countries.

“Despite contradicting views in the media from various Opec members regarding oil price expectations and production levels, we are of the opinion that the low oil price climate will negatively affect all of the Opec members which could cause the cartel to eventually scale down production,” MIDF explained.

Meanwhile, there are also concerns that China would resume its move to devalue the yuan against the US dollar – something the world’s second largest economy has been doing over the past 10 days. Further devaluation of the yuan could add pressure on other Asian currencies, including the ringgit.

“The fear is that China is deliberately devaluing its currency to boost exports and the country’s growth ... any further sharp devaluation of the yuan could create fresh turmoil in regional currencies, including the ringgit,” Suhaimi said.

Beijing has halted the devaluation of the yuan since Monday.

The yuan reference rate was set at 6.4746 to the US dollar on Tuesday, compared with 6.4753 a day earlier, and after having lowered the value of the currency by about 1.3% in the previous two weeks. The yuan is allowed to trade within 2% above or below the fixed rate.

HSBC has projected the yuan to be devalued further to around 6.7 to the US dollar by the end of 2016.

Source: Thestar.com.my

Latest Posts

-

Gong Xi Auction Fair Draws Strong Interest from Both First-Time and Experienced Buyers

-

Gong Xi Auction Fair: Start the Lunar New Year with Smart Property Investments

-

Highest Bidder Strikes Gold at NCM Co November Auction Carnival 2025

-

November Auction Carnival 2025 Returns — Nearly 600 Properties Up for Grabs!

-

SkyWorld raih emas pertama di Anugerah ESG The Edge Malaysia 2025